If you’re looking for ways to streamline your accounting processes, you may have heard of ChatGPT. This advanced technology, developed by OpenAI, has been making waves in the world of artificial intelligence (AI) for its language processing capabilities. But can it do accounting?

The answer is, well, sort of. While ChatGPT wasn’t specifically designed for accounting tasks, it does have the potential to automate certain aspects of financial management. By leveraging machine learning, ChatGPT can be trained to recognize patterns in financial data and provide insights that could benefit businesses and individuals alike.

However, it’s important to note that ChatGPT is not a replacement for human accountants. While it may be able to automate certain tasks, such as bookkeeping and data entry, there are still many aspects of accounting that require human expertise and judgment.

Additionally, there are concerns about the potential biases and limitations of using AI in financial decision-making, which must be carefully considered before implementing any new technology.

Post Contents

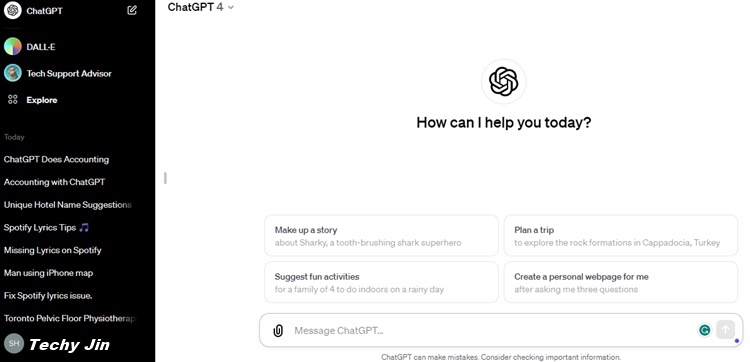

Understanding ChatGPT

ChatGPT is an advanced artificial intelligence language model, designed and developed by OpenAI. This cutting-edge technology is capable of carrying out a variety of tasks, including natural language understanding, question-answering, and text generation. ChatGPT’s advanced natural language processing capabilities have transformative potential in revolutionizing accounting tasks.

By leveraging its capabilities, ChatGPT can streamline and automate various accounting processes, improving efficiency and accuracy. The integration of ChatGPT can redefine the way accounting tasks are approached and executed.

1. ChatGPT Accounting Capabilities

The use of ChatGPT can significantly improve the efficiency of accounting processes by automating repetitive tasks and interpreting accounting data in an accurate and timely manner. Moreover, ChatGPT can be used as a chatbot for accounting, allowing users to communicate with the software in a conversational style, making the process more user-friendly and accessible.

Using artificial intelligence for accounting tasks is not a new concept, but the advent of models like ChatGPT takes this to a new level. ChatGPT’s ability to comprehend and analyze financial data and provide relevant insights makes it a valuable tool for accountants and businesses alike.

2. AI for Accounting Tasks

Beyond just bookkeeping, AI can assist in a variety of accounting tasks like financial analysis, predicting trends, and decision making. With ChatGPT’s superior natural language processing capabilities, it can swiftly understand and interpret complex financial data, providing valuable insights to accountants, auditors, and business leaders.

By training ChatGPT to recognize patterns in accounting data, it gains the ability to make accurate predictions about future performance and identify potential financial risks. This empowers businesses to make informed decisions and take proactive measures to mitigate risks.

ChatGPT’s pattern recognition capabilities in accounting data analysis contribute to enhanced financial planning and risk management. This AI technology can assist in portfolio management, forecasting, and scenario planning.

3. Chatbot for Accounting

Certainly! The chatbot feature of ChatGPT can play a crucial role in improving the accessibility of accounting information. By leveraging natural language processing capabilities, the chatbot can conversationally interact with employees and clients, making it easier for them to obtain the information they need.

With its conversational interface, the software can answer questions related to accounting processes, explain financial terms to clients, and assist in resolving accounting-related queries.

Chatbots can collect data, reconcile accounts, process invoices, and record transactions, enhancing accounting processes. This automation can save time and reduce the potential for errors.

Using ChatGPT can also free up accounting professionals to focus on more complex and strategic tasks, improving the overall quality of financial management.

In summary, bypassing ChatGPT’s advanced language processing capabilities offers a wide range of applications in the accounting industry. ChatGPT’s potential to transform accounting includes automating tasks, providing financial insights, and supporting decision-making.

Applying Machine Learning in Accounting

If you’re an accountant, you’re likely seeking ways to improve efficiency and accuracy in your work. Machine learning is an area of artificial intelligence (AI) that has the potential to automate many tasks and make accounting easier. ChatGPT, an AI language model, assists in bookkeeping and automates repetitive accounting tasks.

ChatGPT can analyze data, learn from it, and then apply that learning to other data sets. This allows it to identify patterns and anomalies in financial information quickly and accurately. For example, ChatGPT can use natural language processing (NLP) to extract information from documents such as invoices and receipts, and then categorize that data into relevant accounts.

One of the areas in ChatGPT that is most effective is bookkeeping. Automating the data entry process through machine automation significantly decreases the chance of mistakes compared to manual data input. This, in turn, makes financial reports more accurate and more timely.

ChatGPT is capable of automating repetitive accounting work like invoice generation and bill payment to save time and reduce human errors.

ChatGPT Bookkeeping Example

| Task | Description |

|---|---|

| Recording Transactions | ChatGPT can analyze large volumes of data, classify it into the relevant accounts, and record it in your accounting software. |

| Bank Reconciliation | ChatGPT can compare your bank statement and transactions, and reconcile them in real-time. |

| Budgeting | ChatGPT can use historical data to make informed predictions about future spending and revenue, aiding in creating realistic budgets. |

| Financial Reporting | ChatGPT can create financial statements quickly and accurately, streamlining the reporting process. |

In addition to aiding in bookkeeping and automating tasks, machine learning can also be used in financial analysis. By analyzing large volumes of data, businesses can get real-time insights into their financial performance, identify areas for improvement, and make data-driven decisions.

However, while ChatGPT and other machine-learning tools offer many benefits, there are some limitations and risks to consider. One limitation is that ChatGPT and other AI tools are only as accurate as the data they collect. If the data is incomplete or inaccurate, the results will be too. Additionally, there is a risk of bias in the data, which can lead to inaccurate predictions and decisions.

Another risk is that ChatGPT is still a relatively new technology and not all accountants may be comfortable using it. In addition, there may be concerns about data privacy, as ChatGPT requires access to sensitive financial information to function.

Overall, the automation and efficiency that machine learning can bring to accounting tasks, such as bookkeeping and financial analysis, make it an exciting area of development in the industry. While it’s important to consider the limitations and risks associated with ChatGPT, it is clear that it has the potential to significantly improve accounting processes.

ChatGPT for Financial Management

ChatGPT can be a valuable tool for financial management, offering potential solutions to efficiently manage finances and make informed decisions. By leveraging artificial intelligence in accounting, ChatGPT can provide real-time insights and financial analysis, aiding businesses and individuals in making well-informed financial decisions.

One potential area where ChatGPT could be utilized is in providing investment advice. By analyzing financial data and market trends, ChatGPT could provide personalized investment recommendations to individuals, based on their financial goals and risk tolerance. This could potentially lead to more successful investment outcomes with lower risk.

Another way ChatGPT could be used for financial management is in risk management. By analyzing financial data and potential market risks, ChatGPT could help businesses and individuals identify potential risks and develop strategies to mitigate them. This could help minimize financial loss and better protect assets.

1. Financial Analysis

ChatGPT could also be used for financial analysis, granting users access to real-time financial insights. For example, ChatGPT could help businesses identify trends in their financial data, such as changes in revenue or spending. This could help businesses make data-driven decisions and optimize their financial strategies.

Another potential application of ChatGPT in financial analysis is in identifying anomalies or errors in financial data. By analyzing large datasets, ChatGPT could identify potential errors or inconsistencies that may have been missed by human analysts, improving accuracy and efficiency.

2. Implementation Challenges

While ChatGPT offers significant potential benefits, there are also implementation challenges to consider. One potential challenge is the need for data privacy and protection. As ChatGPT would be analyzing sensitive financial data. It is critical to ensure that data is protected and not accessible by unauthorized parties.

Another challenge is ensuring that ChatGPT is not biased in its analysis. AI systems can sometimes be influenced by the data they are trained on, leading to potential biases. It is important to ensure that ChatGPT is trained on diverse data sets and regularly monitored for potential biases.

Overall, ChatGPT shows promise in financial management and offers potential solutions for businesses and individuals. However, it is essential to consider the limitations and implementation challenges associated with its use. With proper safeguards and monitoring, ChatGPT and other AI solutions could play a significant role in shaping the future of financial management.

Addressing Limitations and Risks:

While ChatGPT shows potential in simplifying accounting processes. It is important to consider the limitations and potential risks associated with its use in financial management.

One concern is the accuracy of ChatGPT’s predictions, as they are based on its training data and the quality of the algorithm. There is a possibility of biased or incomplete data, which could lead to incorrect accounting results.

Data privacy is another concern, as sensitive financial information could be at risk of exposure or cyber-attacks. It is essential to ensure that proper security measures are in place to safeguard confidential data.

Furthermore, while ChatGPT can automate certain tasks, it cannot replace human decision-making and judgment in financial management. Therefore, it is necessary to exercise caution and have human oversight in all accounting decisions.

“Financial management requires not only the right data but also human experience and insight. ChatGPT can complement this but not replace it.”

Avoid relying solely on ChatGPT for decision-making, as there may be ethical considerations. For example, ChatGPT can assist in identifying fraudulent activities. It may also lead to false accusations or wrongful convictions if not used judiciously.

It is always vital to evaluate the potential risks and rewards before implementing any technology in financial management. In conclusion, while ChatGPT presents exciting possibilities, it is essential to proceed with caution and appropriate oversight.

Future Implications and Adoption

When it comes to the future of ChatGPT in accounting, the possibilities are exciting. As technology continues to evolve, AI solutions like ChatGPT could become a staple in the industry. In fact, according to a recent study, 93% of finance professionals believe that AI technology will be important to the future of the industry.

The potential of ChatGPT lies in its ability to automate repetitive tasks and provide real-time insights. This could free up accounting professionals to focus on more complex tasks, improving efficiency and accuracy. Additionally, ChatGPT could help small businesses and individuals manage their finances, providing valuable insights at a fraction of the cost of hiring a professional accountant.

Also Read: Top Competitor Analysis Tools to Drive Your Business Growth

However, there are also potential challenges to the adoption of ChatGPT in accounting. One major concern is data privacy the use of AI technology comes with inherent risks to sensitive financial information.

Despite these challenges, the adoption of ChatGPT in accounting is already underway. Several major companies have already implemented AI solutions for financial management, and the trend is expected to continue. As more businesses and individuals become comfortable with the technology, the adoption rate is expected to accelerate.

Overall, the future of ChatGPT in accounting is promising. As the technology continues to advance, it has the potential to revolutionize financial management. However, it is important to proceed with caution and consider the potential risks and limitations associated with its use.

Conclusion

In conclusion, ChatGPT, an advanced language model developed by OpenAI, shows great potential in automating certain accounting tasks and providing financial insights. However, it is important to consider the limitations and risks associated with its use. Such as biases and the need for human oversight in decision-making. As technology continues to advance, ChatGPT and similar AI solutions may become more prevalent in the accounting industry.

Businesses and accounting professionals need to stay informed about the capabilities and advancements of ChatGPT and other AI technologies. That can potentially impact the field of accounting. By keeping an open mind to new technologies and solutions, you may be able to improve efficiency and accuracy in your financial management processes.

Remember that while ChatGPT may provide automation and insights, it is not a replacement for human knowledge and expertise. It is crucial to maintain a balance between utilizing technology and the human touch in decision-making processes.

In summary, ChatGPT has the potential to revolutionize the accounting industry, but it is important to approach its use with caution and consideration of its limitations and risks. Keeping an open mind and adapting to new technologies can help you stay ahead in the ever-evolving field of accounting.

FAQ

Can ChatGPT be used for accounting tasks?

ChatGPT has the potential to assist in accounting tasks by automating certain processes and providing financial insights. However, it is important to consider its limitations and the need for human oversight in decision-making.

What is ChatGPT?

ChatGPT is an artificial intelligence language model developed by OpenAI. It is designed to generate human-like responses and engage in conversational interactions.

How can ChatGPT be applied in accounting?

ChatGPT can be used in accounting for various purposes, such as automating bookkeeping processes, providing real-time financial analysis, and offering decision-making support. However, it is essential to understand its limitations and potential biases.

What are the limitations and risks of using ChatGPT in accounting?

Some limitations and risks associated with using ChatGPT in accounting include concerns about data privacy, potential biases in the generated responses, and the need for human verification and oversight in critical financial decisions.

What is the future of ChatGPT in the accounting industry?

The future implications of ChatGPT in the accounting industry are still unfolding. While it may offer opportunities for efficiency and improved financial management, its adoption and widespread use will depend on addressing challenges and concerns surrounding its application.